Funding Fee: What It Is and How It Affects Leveraged Trading

Understand funding fees in leveraged trading, how they work in perpetual futures, and how they impact trading costs and profits.

A funding fee is a recurring payment made between traders in perpetual futures markets. Unlike traditional futures contracts, perpetual contracts do not expire. Instead, funding fees are used to anchor the perpetual contract price to the spot price.

When the perpetual price is above spot, long traders pay shorts

When the perpetual price is below spot, short traders pay longs

Exchanges facilitate the payment but do not usually collect the fee themselves.

Why Funding Fees Exist

Price Alignment Mechanism

Without expiration dates, perpetual contracts rely on funding fees to prevent large deviations from spot prices. Funding fees encourage traders to take positions that bring the contract price back in line with the market.

Market Balance

Funding fees discourage overcrowded positions on one side of the market, reducing extreme imbalances between longs and shorts.

How Funding Fees Work

Funding Rate and Interval

Funding fees are calculated using a funding rate, typically applied every 8 hours, though intervals vary by exchange.

The funding rate depends on:

Interest rate difference

Premium or discount to spot price

Market demand for leverage

Funding Fee Formula

Funding Fee = Position Size × Funding Rate

The fee is paid at the funding timestamp and affects realized PnL.

Example of Funding Fee Calculation

Long Position Example

Position Size: $50,000

Funding Rate: +0.01%

Funding Interval: 8 hours

Funding Fee = $50,000 × 0.01% = $5 paid

Short Position Example

Position Size: $30,000

Funding Rate: −0.02%

Funding Fee = $30,000 × 0.02% = $6 received

Even small funding rates can add up over time.

Who Pays and Who Receives the Funding Fee?

Long Pays Short

When the funding rate is positive

Indicates bullish market sentiment

Long traders pay to maintain their positions

Short Pays Long

When the funding rate is negative

Indicates bearish sentiment

Short traders cover the funding cost

Funding Fees in Leveraged Trading

Amplified Cost with Leverage

Funding fees are calculated on the full position size, not the margin used. This means:

Higher leverage increases funding costs

Long-term leveraged positions are more expensive

Impact on Profitability

Funding fees reduce net profits and increase losses, particularly for swing traders and position traders.

Funding Fees and Realized PnL

Funding fees directly affect realized PnL:

Paid funding fees reduce realized profits

Received funding fees increase net gains

Ignoring funding fees leads to inaccurate performance tracking.

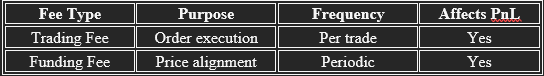

Funding Fees vs Trading Fees

Both fees must be accounted for in strategy planning.

Funding Fees in Crypto vs Traditional Markets

Crypto Markets

Funding fees change frequently

High volatility causes extreme rates

Retail traders are more exposed

Traditional Futures Markets

No funding fees

Use expiration and settlement

Less frequent price dislocations

How Funding Fees Affect Different Trading Styles

Scalping

Minimal impact due to short holding periods.

Day Trading

Moderate impact depending on funding intervals.

Swing and Position Trading

High impact, especially during prolonged bullish or bearish trends.

Funding Fees and Liquidation Risk

Hidden Margin Drain

Funding fees reduce available margin over time, bringing positions closer to liquidation price.

High Funding Periods

Extreme funding rates often signal overheated markets and increased liquidation risk.

Managing Funding Fees Effectively

Monitor Funding Rates

Always check funding rates before opening positions.

Time Entries Strategically

Entering positions just after a funding payment can reduce costs.

Use Lower Leverage

Lower leverage reduces funding exposure.

Hedge Funding Costs

Advanced traders use hedging strategies to offset funding expenses.

Funding Fees in Algorithmic and AI Trading

In algorithmic trading and AI-powered trading bots, funding fees are incorporated into strategy logic.

Professional systems:

Avoid high funding environments

Rotate between spot and futures markets

Optimize holding periods

Ignoring funding fees can invalidate backtesting results.

Common Mistakes Traders Make with Funding Fees

Ignoring funding rate history

Holding positions during extreme funding

Confusing funding fees with trading fees

Overleveraging without accounting for costs

Avoiding these mistakes improves long-term profitability.

Why Funding Fees Matter for Long-Term Traders

Funding fees compound over time. Even profitable trades can turn unprofitable if funding costs are too high.

Understanding funding fees allows traders to:

Plan trades more effectively

Reduce hidden costs

Improve risk-adjusted returns

Trade more professionally

Funding fees are a fundamental component of leveraged trading in perpetual futures markets. While they help maintain price alignment between futures and spot markets, they also introduce hidden costs that can significantly impact profitability.

By understanding how funding fees work, who pays them, and how they affect realized PnL, traders can make smarter decisions, manage risk more effectively, and avoid unnecessary losses. Whether trading manually or using AI-driven strategies, mastering funding fees is essential for success in leveraged crypto trading.