Maintenance Margin: What It Is and How It Differs from Initial Margin

Understand maintenance margin, how it differs from initial margin, and how proper margin management helps traders avoid liquidation.

Maintenance margin is the minimum level of equity a trader must maintain in their account to prevent liquidation of an open leveraged position. If account equity falls below this threshold, the exchange will issue a margin call or automatically liquidate the position.

Maintenance margin exists to:

Protect exchanges from losses

Ensure traders can cover adverse price movements

Reduce systemic risk in leveraged markets

Why Maintenance Margin Exists

Risk Control for Exchanges and Traders

Without maintenance margin, traders could accumulate losses beyond their deposited funds, exposing exchanges to counterparty risk. Maintenance margin ensures losses are capped and positions are closed before accounts turn negative.

Market Stability

Maintenance margin requirements help prevent excessive leverage, reducing the likelihood of mass liquidations during volatile market conditions.

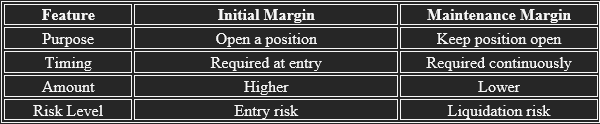

Initial Margin vs Maintenance Margin

Understanding the difference between initial margin and maintenance margin is essential for every trader.

Initial Margin

Initial margin is the amount of capital required to open a leveraged position. It represents the upfront collateral needed to enter a trade.

Maintenance Margin

Maintenance margin is the minimum ongoing balance required to keep that position open.

Key Differences Explained

If account equity drops below maintenance margin, liquidation becomes imminent.

How Maintenance Margin Works in Trading

Equity and Margin Balance

Account equity is calculated as:

Account Balance + Unrealized PnL

When losses increase, equity decreases. Once equity reaches the maintenance margin level, the position is at risk.

Margin Call vs Liquidation

Margin Call: Warning that equity is close to maintenance margin

Liquidation: Forced closure when equity falls below maintenance margin

Some crypto exchanges skip margin calls entirely and liquidate instantly.

Maintenance Margin in Leveraged Crypto Trading

Why Crypto Traders Face Higher Margin Risk

Crypto markets are:

Highly volatile

Open 24/7

Often offer high leverage (up to 100×)

These factors make maintenance margin breaches more common in crypto trading than in traditional markets.

Maintenance Margin Ratios

Most exchanges express maintenance margin as a percentage of position size. For example:

Initial margin: 10%

Maintenance margin: 5%

As position size grows, maintenance margin requirements increase.

Example of Maintenance Margin in Practice

Long Position Example

Account Balance: $5,000

Position Size: $50,000

Initial Margin: $5,000

Maintenance Margin: $2,500

If unrealized losses reduce equity below $2,500, liquidation occurs.

Short Position Example

Position Size: $40,000

Maintenance Margin: $2,000

A sudden price spike can quickly push equity below the maintenance margin level.

Factors That Affect Maintenance Margin

Leverage Level

Higher leverage reduces the distance between current price and liquidation price, increasing maintenance margin risk.

Position Size

Larger positions require higher maintenance margin amounts.

Market Volatility

High volatility increases unrealized losses, reducing equity faster.

Fees and Funding Rates

Trading fees and funding payments reduce available margin, effectively raising maintenance margin pressure.

Maintenance Margin and Liquidation Price

Maintenance margin is directly tied to the liquidation price.

Higher maintenance margin → closer liquidation price

Lower maintenance margin → more price flexibility

Understanding this relationship helps traders place stop-loss orders safely above liquidation levels.

Cross Margin vs Isolated Margin and Maintenance Margin

Isolated Margin

Maintenance margin applies only to one position

Risk is limited to assigned margin

Preferred for beginners and risk control

Cross Margin

Maintenance margin uses entire account balance

One losing trade can drain all funds

Higher risk but more flexibility

Maintenance Margin in Algorithmic and AI Trading

In algorithmic trading and AI trading systems, maintenance margin is continuously monitored.

Professional trading bots:

Adjust leverage dynamically

Reduce exposure during volatility spikes

Close positions early to avoid liquidation

Ignoring maintenance margin can wipe out automated strategies instantly.

Common Mistakes Traders Make with Maintenance Margin

Confusing maintenance margin with initial margin

Using maximum leverage without buffer

Ignoring funding fees

Holding trades during major news events

Overestimating margin safety

These mistakes significantly increase liquidation risk.

How to Manage Maintenance Margin Effectively

Best Practices for Traders

Use conservative leverage

Keep extra margin available

Monitor equity in real time

Set stop-loss orders well above liquidation price

Avoid overexposure during volatile market conditions

Successful traders treat margin as capital protection, not free leverage.

Why Maintenance Margin Matters for Long-Term Trading Success

Maintenance margin determines how long a trader can survive unfavorable market moves. Traders who manage margin carefully:

Avoid forced liquidations

Trade more consistently

Protect psychological capital

Build sustainable strategies

Margin discipline is often the difference between professional traders and gamblers.

Maintenance margin is a foundational concept in leveraged trading. It represents the minimum equity required to keep positions open and avoid liquidation. While initial margin allows traders to enter positions, maintenance margin determines whether they can stay in the trade.

By understanding how maintenance margin works, how it differs from initial margin, and how it affects liquidation risk, traders can make smarter decisions, manage leverage responsibly, and protect their capital in volatile markets.

Mastering maintenance margin is not optional it is essential for anyone serious about crypto, futures, or margin trading.