Liquidation Price: What It Is and Why Traders Should Care

Learn what liquidation price is, why it matters in leveraged trading, and how traders can avoid forced liquidation and losses.

The liquidation price is the market price at which a leveraged position is forcibly closed by the exchange because the trader’s margin can no longer cover losses.

Once the liquidation price is reached:

The position is closed automatically

The trader loses most or all of the margin

The trade cannot be recovered

Liquidation protects exchanges from negative balances but exposes traders to sudden and total losses.

Why Liquidation Happens in Trading

Insufficient Margin

Liquidation occurs when a trader’s account margin falls below the maintenance margin required to keep the position open.

High Leverage

The higher the leverage, the closer the liquidation price is to the entry price. Even small price movements can trigger liquidation.

Market Volatility

Cryptocurrency markets are extremely volatile. Sudden price spikes or crashes can push prices to liquidation levels within seconds.

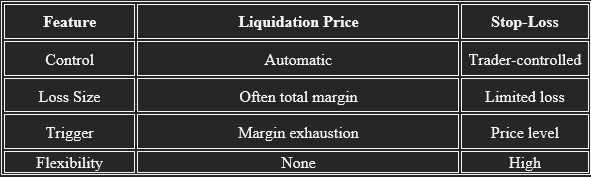

Liquidation Price vs Stop-Loss

Key Differences

A stop-loss is a risk management tool, while liquidation is a failure of risk management.

How Liquidation Price Is Calculated

Basic Factors in Liquidation Price Calculation

Liquidation price depends on:

Entry price

Leverage used

Initial margin

Maintenance margin

Trading fees

Each exchange uses a slightly different formula, but the concept remains the same.

Liquidation Price Formula (Simplified)

Long Position

Liquidation Price ≈

Entry Price − (Initial Margin − Maintenance Margin) ÷ Position Size

Short Position

Liquidation Price ≈

Entry Price + (Initial Margin − Maintenance Margin) ÷ Position Size

The higher the leverage, the smaller the distance between entry price and liquidation price.

Example of Liquidation Price in Crypto Trading

Long Trade Example

Entry Price: $40,000

Leverage: 20×

Margin: $2,000

Maintenance Margin: $1,200

A small 5% market drop could push the price to liquidation, wiping out the position.

Short Trade Example

Entry Price: $30,000

Leverage: 15×

Margin: $2,000

A rapid price spike can liquidate the trade within minutes during high volatility.

Liquidation Price in Leveraged Crypto Trading

Why Crypto Traders Face Higher Liquidation Risk

Crypto markets operate:

24/7

With extreme volatility

With high leverage options (up to 100×)

These conditions make liquidation more frequent than in traditional markets.

Liquidation Cascades

When many traders are liquidated simultaneously, it can trigger liquidation cascades, accelerating price crashes or spikes.

Impact of Fees on Liquidation Price

Hidden Risk: Fees Reduce Margin

Trading fees and funding fees reduce available margin, effectively moving the liquidation price closer to the current market price.

High-frequency traders and scalpers are especially vulnerable.

Liquidation Price and Risk Management

Use Lower Leverage

Lower leverage increases the distance between entry price and liquidation price, giving trades more room to breathe.

Always Use Stop-Loss Orders

Stop-loss orders close trades before liquidation, preserving capital.

Proper Position Sizing

Never risk a large portion of your account on a single trade.

Maintain Extra Margin

Keeping unused margin reduces liquidation risk during temporary volatility.

Liquidation in Isolated vs Cross Margin

Isolated Margin

Only assigned margin is at risk

Liquidation affects a single position

Better for risk control

Cross Margin

Entire account balance is used as margin

One liquidation can drain the whole account

Higher risk for beginners

Liquidation Price in AI and Algorithmic Trading

In AI trading bots and algorithmic systems, liquidation price is a key parameter.

Professional systems:

Automatically adjust leverage

Monitor margin levels in real time

Reduce exposure during high volatility

Ignoring liquidation risk can destroy even profitable algorithms.

Common Mistakes Traders Make with Liquidation Price

Using maximum leverage to chase profits

Ignoring maintenance margin requirements

Not accounting for fees

Holding positions during major news events

Overconfidence after winning streaks

These mistakes dramatically increase liquidation risk.

How to Avoid Liquidation as a Trader

Best Practices

Use conservative leverage

Set stop-loss orders immediately

Monitor funding rates

Avoid trading during extreme volatility

Keep risk per trade below 1–2%

Professional traders prioritize survival over profits.

Why Liquidation Price Matters for Long-Term Success

Liquidation resets a trader’s account to zero. Recovering from a full liquidation is emotionally and financially difficult.

Traders who understand and respect liquidation price:

Trade more consistently

Preserve capital

Stay in the market longer

Build sustainable strategies

The liquidation price is one of the most important concepts in leveraged trading. It defines the boundary between controlled risk and total loss. Whether trading cryptocurrencies, futures, or forex, ignoring liquidation price can lead to devastating results.

By understanding how liquidation price works, using proper risk management, controlling leverage, and applying stop-loss strategies, traders can protect their capital and improve long-term performance in volatile markets.

Mastering liquidation risk is not optional—it is essential for every serious trader.