The History of the Stock Telegraph Ticker and Its Role in Modern Financial Markets

The history of the stock telegraph ticker invented by Edward Augustine Calahan and how it changed financial markets by making price information faster, clearer, and more accessible.

Financial Markets Before the Stock Telegraph Ticker

Traditional Methods of Sharing Financial Information

In the first half of the nineteenth century, financial markets were very basic in how they shared information. Stock and commodity prices were mostly carried by human messengers called “runner boys.” These messengers took prices by word of mouth or on paper from the stock exchange floor to brokerage offices. There were also hand-written boards near stock exchanges, but they were updated slowly and only in limited places. Regular telegraph messages were sometimes used, but they needed human operators and were often slow and inaccurate.

Structural Problems of Old Markets

These methods created many serious problems. First, there was a long delay, so prices were already old when traders received them. Second, human error was very common. Third, there was strong information inequality, because offices closer to the stock exchange received prices earlier than others. Finally, there was no clear and reliable record of trades, which made market analysis difficult.

Economic Effects of These Limits

Because of these problems, markets were easy to manipulate, had low transparency, and small investors were always weaker than large institutions. As a result, there was a strong need for a faster, automatic, and shared system to send financial information.

Edward Augustine Calahan and the Birth of the Ticker Idea

Calahan’s Professional Life

Edward Augustine Calahan was born in 1838 and spent most of his career working in the telegraph industry. Unlike many inventors of his time, he did not work in isolated laboratories. Instead, he worked inside real telegraph networks. This allowed him to see the real problems of information transfer every day.

A Revolutionary Idea

Calahan realized that the main problem of financial markets was not the lack of information, but how the information was delivered. Telegraph lines could send data very fast, but human operators slowed the process and caused mistakes. His key idea was to build a machine that could receive telegraph signals and print them automatically, without human interpretation.

The Invention of the Stock Telegraph Ticker in 1867

Official Introduction

On November 15, 1867, Calahan introduced the first working stock telegraph ticker in New York City. The machine was connected to telegraph lines and printed stock prices continuously on a narrow paper strip. The regular “tick-tick” sound made while printing gave the machine its name: the ticker.

Patent and Official Recognition

In 1868, Calahan officially registered his invention under the name “Improvement in Telegraphic Indicators.” This patent marked the beginning of the commercial use and spread of the stock telegraph ticker in brokerage offices.

How the Stock Telegraph Ticker Worked

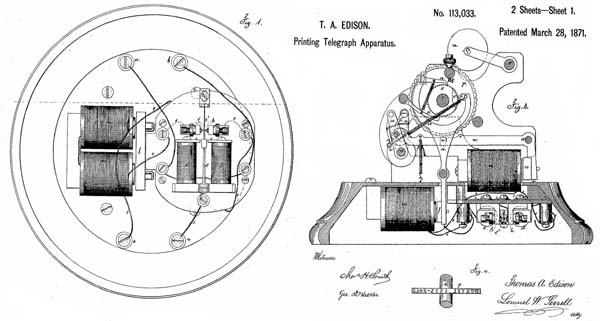

Main Parts of the Machine

The stock ticker had several main parts: an electromagnetic receiver to get telegraph signals, gears and moving mechanical parts, a narrow paper strip called ticker tape, and a printing hammer that printed letters and numbers.

How the Machine Operated

An exchange operator sent the company symbol and stock price using telegraph code. The electrical signal traveled through the telegraph wires and was changed into mechanical movement inside the ticker. This movement printed the information on the paper tape. In this way, prices were recorded and shared automatically and continuously.

Key Innovation

The main innovation of the stock telegraph ticker was that financial information became a continuous flow and could be received at the same time in many different places. This completely changed how economic data was shared.

Immediate Changes After the Ticker Was Invented

A Speed Revolution

With the stock ticker, the time between a trade and the spread of information became very short. Prices were shared almost instantly, and markets entered a new age of speed.

More Transparency and Trust

Wider access to information reduced fraud and increased public trust in financial markets. More transparency also encouraged small investors to take part in trading.

Changes in Financial Jobs

The stock telegraph ticker helped create new types of jobs, such as price analysts, information-based traders, and companies that specialized in financial data distribution.

Later Inventors and Companies

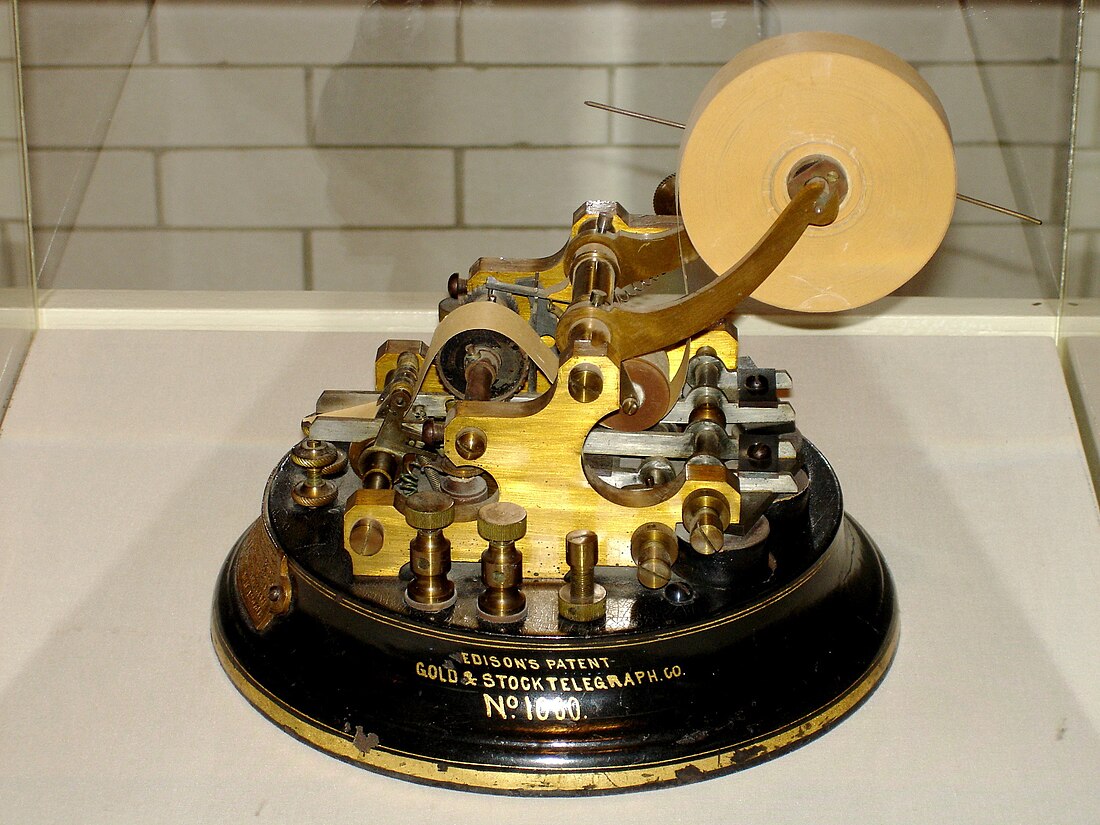

Thomas Edison’s Improvements

Thomas Edison designed faster and more accurate versions of the ticker. His models had fewer mechanical problems and were better for large-scale use.

The Role of Western Union

Western Union expanded its telegraph network and helped turn the stock telegraph ticker into an industry standard across the United States.

Long-Term Economic Effects

Creation of National Markets

Before the ticker, markets were mostly local. After its invention, the New York Stock Exchange became a national center, and prices became more consistent across the country.

The Idea of Efficient Markets

The stock ticker was an early step toward the idea that prices reflect available information. This idea later became known as the Efficient Market Hypothesis in modern financial theory.

Cultural and Social Effects of the Ticker

Finance Enters Popular Culture

Used ticker tapes were later thrown during public celebrations, leading to the famous “ticker-tape parades” in American culture.

A New Sense of Time

The stock telegraph ticker introduced the idea of instant information into daily life and trained people to react more quickly to events.

From Mechanical Tickers to the Digital Age

Move to Electronic Technology

In the twentieth century, mechanical and electromechanical tickers were replaced by electronic screens and computer systems.

The Ticker’s Legacy Today

LED stock boards, scrolling prices on financial TV channels, and modern trading apps all come from the same basic idea that Calahan introduced more than a century ago.r